BLOGS

16 Dec 2025

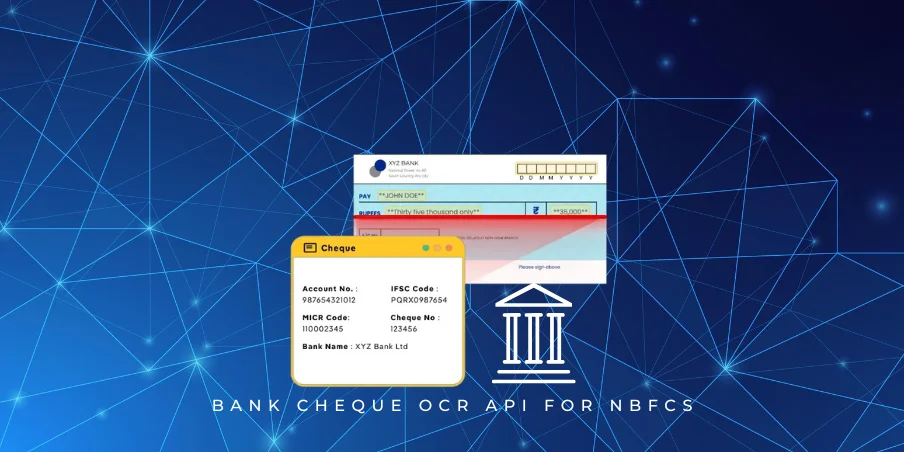

Bank Cheque OCR API for NBFCs: Automation Guide 2026

Bank Cheque OCR API for NBFCs is rapidly becoming a mission-critical technology as the lending and fintech ecosystem evolves toward fully automated workflows. With rising customer expectations for instant approvals, increased cheque-based transactions in semi-urban markets, and higher fraud sophistication, NBFCs can no longer rely entirely on outdated, manual cheque verification practices. By leveraging advanced OCR engines, AI-driven document intelligence, and real-time validation APIs, NBFCs can significantly reduce turnaround time (TAT) and improve operational accuracy—setting the foundation for scalable growth in 2026.

For years, most NBFCs have managed bank cheque verification using manual back-office teams. Staff members visually inspect cheque images, confirm account holder details, match signature patterns, validate MICR codes, and ensure cheque authenticity before processing disbursements or collections. While this traditional approach works at low volumes.

Modern NBFCs handling thousands of cheques monthly face inevitable limitations.

Manual verification introduces several critical challenges: human errors in reading cheque details, inconsistent verification standards between employees, delays caused by high workload, and a growing risk of undetected fraud. Fraudsters today use advanced methods—altered cheque images, forged signatures, manipulated MICR lines—making it nearly impossible for a human reviewer to catch every anomaly. These inefficiencies lead to slower loan approvals, higher operational costs, and compliance risks.

With 2026 expected to bring increased digital adoption, stricter regulatory oversight, and faster lending cycles, the demand for automated cheque verification is rising sharply. NBFCs need solutions that provide accuracy, speed, and fraud detection at scale—something manual teams alone simply cannot deliver.

This is where Bank Cheque OCR APIs play a transformational role. A Cheque OCR API uses Optical Character Recognition and AI/ML to automatically read cheque images, extract all key fields (cheque number, MICR, bank name, branch, IFSC, account holder, date, amount), and verify data instantly. For NBFCs, this means faster onboarding, reduced document handling, better fraud prevention, and seamless integration into existing loan origination or KYC platforms.

This guide is designed to help NBFCs understand why Bank Cheque OCR API for NBFCs is becoming essential in 2026, how it works, what to look for in a solution, and how automation can significantly improve operational efficiency and customer experience.

What Is a Bank Cheque OCR API?

A Bank Cheque OCR API is an AI-powered service that automatically reads cheque images and extracts all important information—such as cheque number, account holder name, MICR code, IFSC, bank name, branch details, date, and amount—without any human intervention. In banking and NBFC workflows, this technology eliminates the need for manual data entry and enables faster, more secure cheque verification at scale.

Definition of OCR in Banking

OCR (Optical Character Recognition) is a technology that converts printed or handwritten text from images into machine-readable data. In the banking ecosystem, OCR is widely used to read documents such as cheques, KYC proofs, account statements, passbooks, and invoices.

For cheque processing, OCR identifies patterns in the cheque layout—MICR line, text blocks, signatures, and numeric fields—and converts them into structured digital information.

How OCR Converts Cheque Images Into Structured Data

When an NBFC uploads a cheque photo or scanned copy, the OCR engine performs a series of steps:

- Reads the raw image (JPG, PNG, PDF).

- Detects regions of interest (ROI) such as cheque number, MICR line, account name, date, and amount.

- Recognizes text using machine learning models trained specifically for Indian cheque formats.

- Cleans and formats the extracted fields into structured JSON output.

This process ensures high accuracy even when cheque images are tilted, low-resolution, or captured on mobile devices.

Key Components of a Cheque OCR API

A powerful Bank Cheque OCR API for NBFCs typically includes:

1. Image Preprocessing Engine

Enhances the cheque image for better accuracy by performing:

- Noise removal

- Skew correction

- Contrast enhancement

- ROI segmentation

- Edge sharpening

This step ensures the Artificial Intelligence model receives a clean, readable image.

2. AI Models for Field Extraction

The OCR engine uses deep-learning models for accurate extraction of:

- Cheque Number

- MICR Code

- IFSC Code

- Bank Name & Branch

- Account Holder Name

- Date

- Amount (in words & digits)

- Signature region detection

These models are trained on thousands of cheque variations used across different Indian banks.

3. Validation Engine

After extraction, the system verifies validity through:

- MICR format checks

- IFSC database validation

- Cheque number consistency

- Date validation (post-dated/expired cheques)

- Bank/branch matching

This ensures the data is correct and usable in downstream workflows.

4. Fraud Detection Indicators

Advanced APIs also analyze risk markers such as:

- Edited or tampered cheque images

- Mismatched fonts in MICR or amount fields

- Signature anomalies

- Unusual cheque patterns

- Duplicate cheque detection

These help NBFCs prevent fraud during loan disbursement or cheque deposit verification.

Why NBFCs Need Cheque OCR Automation in 2026

1.0 Industry Trends Driving Automation

The lending landscape is shifting rapidly, and NBFCs must adapt to remain competitive. Digital onboarding has now become the default expectation rather than a premium feature. Customers applying for loans—whether MSME, consumer, or vehicle financing—expect approvals within hours, not days. Manual cheque verification simply cannot keep up with these new turnaround expectations.

At the same time, NBFCs face increasing pressure to achieve faster loan disbursement cycles, reduce errors, and comply with evolving RBI guidelines around document verification and fraud prevention. The rise in cheque-based fraud—especially altered MICR lines, manipulated cheque numbers, and forged signatures—has made manual inspection far riskier.

This is why many NBFCs are shifting to automated solutions such as the Bank Cheque OCR API for NBFCs, with platforms like AZAPI.ai leading the market by offering AI-driven accuracy of up to 99.94%, even on low-quality or mobile-captured cheque images.

2.0 Operational Challenges Faced by NBFCs Today

Despite digitization in other areas, cheque verification in most NBFCs is still handled manually by back-office teams. This creates multiple operational bottlenecks:

- High manpower cost due to the need for dedicated staff to read MICR codes, match names, and validate account details.

- Frequent manual errors, especially when handling handwritten fields, faint prints, or damaged cheques.

- Slow TAT during onboarding or loan processing, particularly when verification queues pile up.

- Inconsistent data extraction across branches because accuracy depends on individual reviewer skills.

These inefficiencies directly impact customer experience, operational cost, fraud risk, and compliance performance.

3.0 Benefits of Automated Cheque OCR for NBFCs

Adopting an AI-driven system like the AZAPI.ai Bank Cheque OCR API for NBFCs helps eliminate manual bottlenecks and ensures consistent accuracy at scale.

Key benefits include:

- Up to 99.94% accuracy using advanced AI/ML models trained on thousands of cheque variations.

- 10× faster cheque verification, reducing onboarding and disbursement bottlenecks.

- Fraud reduction, as automation catches manipulated MICR lines, edited cheque fields, greyscale tampering, and font mismatches that humans often miss.

- Seamless digital customer journeys, enabling end-to-end onboarding without physical intervention.

- Reduced compliance risk, thanks to automated field validation, RBI-format checks, and consistent workflow logs.

- Automatic audit trails, ensuring every cheque processed is logged, timestamped, and fully traceable for compliance and audit teams.

For NBFCs scaling operations across multiple states or branches, automation ensures uniformity, speed, and reliability that manual teams cannot match.

What Data Can the Bank Cheque OCR API Extract?

A high-performance solution like AZAPI.ai’s Bank Cheque OCR API for NBFCs is capable of extracting detailed, structured data from any Indian bank cheque, including:

- Account Holder Name

- Account Number

- IFSC Code

- MICR Code

- Bank Name

- Branch Name

- Cheque Date

- Cheque Number

- Payee Name

- Signature zone analysis (optional)

- Greyed-out cheque detection (for invalid or low-quality scans)

- Tampering detection (altered images, font mismatch, manipulated MICR, etc.)

This ensures that NBFCs receive clean, validated, and fraud-checked data ready to integrate into LOS, LMS, underwriting, or risk engines.

How Bank Cheque OCR API Works (Step-by-Step Workflow)

The Bank Cheque OCR API for NBFCs follows a structured, automated workflow designed to deliver high accuracy, consistent output, and instant verification. Below is a simplified breakdown of how platforms like AZAPI.ai process cheque images end-to-end.

1.0 Image Upload

The workflow begins when the user uploads a cheque image through any supported channel. NBFCs can integrate the API into:

- Mobile applications

- Web portals

- Backend systems

- SDKs used for field collections

- Scanned document uploads

Supported file formats: JPG, PNG, PDF.

The system accepts both camera-captured images and high-resolution scans.

2.0 Preprocessing

Before the AI engine reads the cheque, the image undergoes enhancement to maximize accuracy. The preprocessing engine performs:

- Rotation correction for tilted or sideways images

- Noise removal to clear background artefacts

- DPI enhancement for low-resolution photos

- Contrast enhancement for faint or unclear printing

AZAPI.ai’s preprocessing layer is optimized for Indian bank cheque variability, ensuring consistent, high-quality input for the model.

3.0 AI Recognition

Once preprocessing is done, the system’s OCR and AI models analyze the cheque. This involves:

- MICR line extraction using deep-learning OCR models

- IFSC lookup validation using an updated Indian bank directory

- Pattern matching with bank templates to map fields like cheque number, account name, date, and amount

AZAPI.ai’s recognition engine is trained on thousands of Indian cheque formats and achieves up to 99.94% accuracy in field extraction.

4.0 Validation Layer

After extraction, the validation engine ensures that every field is correct and fraud-safe. This includes:

- Bank directory validation for MICR, IFSC, bank name, and branch details

- Cross-checking the IFSC–Bank–Branch relationship to detect mismatches

- Fraud pattern scanning, such as altered MICR lines, tampered text, greyed-out images, or inconsistent fonts

This layer ensures reliability and compliance for NBFC workflows.

5.0 API Response

Finally, the API generates a clean, structured output containing all extracted details.

The response includes:

- JSON output with all cheque fields

- Confidence scores for each extracted value

- Error codes where relevant (invalid cheque, low quality, tampering detected, unsupported format, etc.)

This makes integration with LOS, LMS, underwriting, and risk engines seamless and highly scalable.

Use Cases: How NBFCs Are Using Cheque OCR in 2026

The adoption of Bank Cheque OCR API for NBFCs has accelerated in 2026 as lenders increasingly move toward digital-first workflows, automated verification, and fraud-resistant operations. Solutions like AZAPI.ai, with 99.94% extraction accuracy, are enabling NBFCs to streamline KYC, underwriting, mandate registration, repayment setup, and fraud detection across every stage of the customer lifecycle.

1.0 Digital Loan Onboarding

NBFCs now integrate Cheque OCR directly into their LOS/LMS to speed up loan origination.

Key onboarding actions automated through OCR include:

- Capturing a cheque image through mobile apps, web platforms, or field-collection SDKs

- Auto-validating customer bank details such as account number, IFSC, MICR, and bank branch

- Reducing manual errors that previously slowed TAT and increased rejection rates

With instant verification, onboarding is now smoother and faster—critical for personal loans, business loans, and BNPL workflows.

2.0 Mandate Registration (NACH / eNACH)

Mandate setup requires accurate bank information, which NBFCs traditionally extracted manually from cancelled cheques.

With Cheque OCR automation:

- Mandate cheque verification becomes instant

- Bank details are auto-filled for NACH/eNACH forms

- Operational errors are eliminated, especially for large-volume mandates

Platforms like AZAPI.ai help NBFCs achieve high success rates during mandate registration by ensuring flawless data capture.

3.0 Fraud Detection

Cheque fraud cases have increased significantly in the last few years, making automation essential.

OCR-based fraud detection includes:

- Tampered cheque detection (altered MICR, erased digits, added text, etc.)

- Mismatched details between cheque, KYC documents, and customer inputs

- Duplicate cheque usage checks, identifying reused or previously-verified cheques

AI-based anomaly detection flags irregularities that human reviewers often miss, strengthening the NBFC’s risk controls.

4.0 Collections & Repayment Setup

During repayment setup—whether EMI, ECS, or ACH—NBFCs frequently require accurate customer bank details. Cheque OCR simplifies this process by:

- Auto-fetching account details from a cheque in seconds

- Avoiding manual entry errors, reducing repayment failures

- Speeding up EMI auto-debit activation

This reduces onboarding friction and helps NBFCs maintain a healthy repayment pipeline.

Compliance & Security Considerations for 2026

As NBFCs scale their digital operations, compliance, security, and data governance become non-negotiable. Using a Bank Cheque OCR API for NBFCs demands strong alignment with RBI expectations, enterprise-grade encryption, zero-storage policies, and globally recognized security certifications. Solutions like AZAPI.ai are built to meet these evolving legal and technical standards in 2026.

1.0 RBI Guidelines

In 2026, RBI continues to emphasize strict data governance, transparent processing of customer financial information, and secure digital onboarding practices. When NBFCs use automated cheque verification:

- Data handling must comply with RBI’s digital lending and KYC rules

- Customer identity and bank details must be validated using secure, traceable processes

- Auditability and accuracy become essential for regulatory reporting

Using an API provider that aligns with these guidelines ensures risk-free and compliant onboarding flows.

2.0 Data Security Standards

A compliant Cheque OCR solution must offer military-grade security to protect sensitive financial information. Key security measures include:

- AES-256 encryption for data at rest

- HTTPS/TLS 1.2+ encryption for all API requests and responses

- Token-based authentication to ensure only authorized systems access the API

Platforms like AZAPI.ai implement strict access controls and zero-trust security frameworks to safeguard NBFC and customer data.

3.0 Certifications to Look For

Before choosing an OCR partner, NBFCs must verify compliance with global security and privacy standards. The most critical certifications include:

- ISO 27001 – Information Security Management

- SOC 2 Type II – Security, Availability, Processing Integrity, Confidentiality

- GDPR / DPDP readiness – Required for data privacy compliance under India’s new DPDP Act

AZAPI.ai meets all required certifications, making it suitable for enterprise-grade NBFC deployments.

4.0 Data Retention Policies

To stay compliant with RBI and DPDP requirements, Cheque OCR APIs must follow strict data retention rules. This includes:

- No permanent storage of cheque images or extracted data unless explicitly required by the NBFC

- Automatic deletion windows, typically 30–120 seconds, depending on client configuration

- End-to-end session-level data privacy, ensuring no customer information is stored or reused

AZAPI.ai follows a strict zero-retention architecture, making it fully compliant and safe for regulated financial workflows.

Performance Benchmarks (What NBFCs Should Expect in 2026)

As NBFCs increasingly depend on automated cheque verification, understanding the expected performance standards of a Bank Cheque OCR API for NBFCs becomes essential. In 2026, lenders demand not only accuracy and reliability but also the ability to handle high transaction volumes with low latency. Platforms like AZAPI.ai set the benchmark with industry-leading performance built for enterprise-scale operations.

1.0 Accuracy Benchmarks

Modern AI-driven OCR engines deliver significantly higher precision compared to manual verification. In 2026, NBFCs should expect:

- Accuracy between 95%–99% across typical cheque formats

- Up to 99.94% accuracy with advanced models like those used by AZAPI.ai

- Consistent performance on mobile-captured, scanned, or slightly low-quality cheque images

Higher accuracy reduces manual intervention, improves TAT, and decreases mandate or onboarding rejections.

2.0 API Latency (Speed)

Speed is a critical factor, especially during digital onboarding and mandate registration.

NBFCs should expect:

- Sub-second response times (300–700 ms) for typical cheque images

- End-to-end extraction + validation within under 1 second

- Low-latency performance even under peak load

AZAPI.ai uses optimized inference pipelines and load-balanced clusters to ensure lightning-fast processing.

3.0 Throughput Capacity

Enterprise-grade OCR must support high volumes without performance drops. In 2026, expected standards include:

- Tens of thousands of requests per minute

- Horizontal scaling support via distributed inference engines

- No degradation during peak hours (loan drives, month-end cycles, mandate processing spikes)

NBFCs operating at large scale rely on such capacity to maintain operational fluidity.

4.0 Supported File Size Limits

A modern API must handle a wide range of image qualities and formats. Typical benchmarks include:

- Up to 20 MB per file for PDF/JPG/PNG uploads

- Multi-page PDF support (for scanned cheque bundles)

- Intelligent compression on-the-fly for oversized mobile images

Platforms like AZAPI.ai balance file-size flexibility with fast performance.

5.0 Stress-Tested Load Capability

Before deployment, OCR APIs should undergo rigorous stress and chaos testing. NBFCs should look for:

- 100,000+ concurrent request handling without failures

- 99.95%+ uptime SLA

- Auto-scaling architecture for traffic surges

- Fault-tolerant infrastructure with regional redundancy

AZAPI.ai ensures consistent performance even under extreme load, making it suitable for nationwide NBFC operations.

How to Choose the Right Cheque OCR API Provider

Selecting the best Bank Cheque OCR API for NBFCs is crucial for ensuring accuracy, speed, compliance, and scalability across your digital lending workflows. In 2026, NBFCs must evaluate providers on multiple technical, operational, and regulatory parameters to avoid performance bottlenecks or compliance risks. Platforms like AZAPI.ai stand out by offering enterprise-grade accuracy, 99.94% field precision, and full security certifications.

1.0 Accuracy

Accuracy is the single most important factor in cheque OCR. Poor extraction quality leads to mandate failures, incorrect bank details, and compliance issues.

NBFCs should look for:

- 95%–99% field-level accuracy

- Up to 99.94% accuracy (benchmarks achieved by AZAPI.ai)

- High accuracy even on low-quality mobile captures

- Error-handling for tampered, blurred, or greyed-out cheques

A high-accuracy engine reduces manual interventions and speeds up onboarding significantly.

2.0 Speed (Latency)

Cheque verification must be near-instant for digital loan journeys.

The provider should offer:

- Sub-second API response times

- Fast preprocessing + extraction pipelines

- Stable performance during peak hours

Speed directly impacts conversion rates and TAT.

3.0 Compliance Certifications

Since cheque data contains sensitive financial information, compliance is non-negotiable.

Your OCR partner must have:

- ISO 27001 (Information Security Management)

- SOC 2 Type II (security, availability, integrity)

- GDPR/DPDP compliance readiness

- Zero-storage architecture or configurable retention

- RBI-aligned data handling processes

AZAPI.ai meets all major compliance requirements for NBFCs in 2026.

4.0 SDK Availability & Integration Flexibility

The provider should offer multiple integration options for smooth deployment:

- SDKs for Android, iOS, Web, Python, Node.js, Java

- Prebuilt components for mobile capture

- API sandbox for testing

- Sample code + documentation for fast onboarding

Good SDK availability reduces integration effort dramatically.

5.0 Support & SLAs

NBFCs cannot afford downtime or inconsistent performance.

Look for:

- 24×7 technical support

- Guaranteed uptime SLA (99.9%+)

- Dedicated account manager for enterprise clients

- Fast incident response times

Platforms like AZAPI.ai provide enterprise support with strict SLAs.

6.0 Pricing Models

Transparent and scalable pricing helps NBFCs optimize cost as volumes grow. Providers typically offer:

- Usage-based pricing (per API call)

- Volume-based discounts

- Custom enterprise plans

- Bundle pricing for OCR + onboarding suite

Choose a model that aligns with your projected transaction volume.

7.0 Template Adaptability (Indian Bank Formats)

India has 100+ bank cheque formats, each with variations in layout, fonts, security patterns, and MICR printing styles.

Your OCR provider must support:

- Dynamic template recognition

- Bank-wise and branch-level pattern detection

- AI-driven template adaptability (no hard-coded templates)

- Consistent performance across all private, public, cooperative banks

AZAPI.ai’s model is trained on thousands of real cheque variations across Indian banks, ensuring near-universal compatibility.

Pricing Models for Cheque OCR

Per API Call (Pay-as-you-go)

- Ideal for low-volume NBFCs or early-stage usage

- No monthly commitment

- Billing based on the number of cheques processed

- Simple and transparent for testing or pilot phases

Pack-Based Pricing

- Pre-purchased API bundles (10k, 50k, 1 lakh calls, etc.)

- Lower per-call cost than pay-as-you-go

- Suitable for predictable monthly volumes

Volume Discounts

- Discounts increase as monthly usage grows

- Common for mid- to large-size NBFCs

- Negotiated based on average monthly traffic

Enterprise Pricing

- Custom SLAs, dedicated throughput, priority support

- Option for on-premise or VPC deployment

- Best for large NBFCs, lending platforms, and payment institutions

Optional Add-On Features

- Fraud detection (tamper check, duplicate checks)

- Signature matching module

- Advanced analytics dashboards

- Custom template training for rare cheque formats

Conclusion

In 2026, cheque OCR has become a critical enabler for NBFCs striving for faster, more secure, and fully digital banking workflows. With rising customer expectations, compliance pressures, and increasing fraud risks, manual cheque verification is no longer scalable or reliable.

Automating the process with a high-accuracy solution like AZAPI.ai’s Cheque OCR (99.94% accuracy) empowers NBFCs to reduce verification time from minutes to seconds, eliminate manual errors, and maintain consistent compliance across branches. The result is faster onboarding, lower operational costs, improved fraud detection, and a smoother customer experience.

As the lending ecosystem moves toward digital-first onboarding and real-time verification, adopting a robust Cheque OCR API is no longer optional — it’s essential for operational efficiency and competitive advantage.

FAQs:

1. What is a Bank Cheque OCR API for NBFCs?

Ans: A Bank Cheque OCR API for NBFCs is a software interface that extracts key cheque details—such as account number, IFSC, MICR, bank name, and cheque number—from an uploaded cheque image. Platforms like AZAPI.ai use advanced AI and deep learning to convert cheque photos into structured data with very high accuracy.

2. How does AZAPI.ai’s Cheque OCR API improve NBFC onboarding?

Ans: AZAPI.ai drastically speeds up digital onboarding by automating bank account verification. Instead of manually reading cheque details, NBFCs can auto-extract all information in milliseconds with 99.94% accuracy, making loan approval faster, more reliable, and compliant with RBI guidelines.

3. What data can be extracted using a Bank Cheque OCR API?

Ans: A standard Bank Cheque OCR API for NBFCs can extract:

- Account holder name

- Account number

- IFSC

- MICR

- Bank & branch

- Cheque number & date

- Payee name

- Signature zone indicators

- Tampering alerts

Solutions like AZAPI.ai offer extended fraud detection and greyed-out cheque detection for added accuracy.

4. Why do NBFCs need cheque OCR automation in 2026?

Ans: NBFCs in 2026 face rising digital onboarding volumes, stricter RBI compliance, and increased cheque fraud cases. A Bank Cheque OCR API helps them automate verification, reduce TAT, lower costs, and improve accuracy. AZAPI.ai specifically supports high-speed onboarding pipelines with sub-second response times.

5. How accurate is AZAPI.ai’s Bank Cheque OCR API compared to others?

Ans: Most cheque OCR APIs offer 95–99% accuracy, but AZAPI.ai delivers 99.94%+ accuracy, thanks to custom-trained models on Indian bank cheque formats (100+ templates). This makes AZAPI.ai one of the most reliable OCR engines for NBFC use cases.

6. Is the Bank Cheque OCR API compliant with RBI and security standards?

Ans: Yes. Leading providers like AZAPI.ai comply with RBI’s data-handling norms, support AES-256 encryption, HTTPS, token-based authentication, and are certified with ISO 27001, SOC 2 Type II, and DPDP/GDPR readiness.

7. Can NBFCs integrate the Cheque OCR API into apps and onboarding portals?

Ans: Absolutely. The Bank Cheque OCR API for NBFCs can be integrated into mobile apps, web onboarding journeys, LOS/LMS systems, and internal verification dashboards. AZAPI.ai provides SDKs, sandbox access, and sample code for quick integration.

8. How fast is the API response time?

Ans: AZAPI.ai offers sub-second response time even under high load, making it suitable for large-scale onboarding operations. This speed is crucial for NBFCs handling thousands of verifications daily.

9. What are the pricing models for cheque OCR APIs?

Ans: Pricing varies based on monthly usage, but typically includes:

- Per API call pricing

- Monthly packs

- Volume discounts

- Enterprise plans

AZAPI.ai provides flexible pricing for NBFCs and fintechs with high transaction volumes.

10. Does the API detect fraudulent or tampered cheques?

Ans: Yes. Modern solutions like AZAPI.ai include fraud detection features such as:

- Tampered MICR line detection

- Greyscale/masked cheque detection

- Altered number zone analysis

- Duplicate cheque usage alerts

This helps NBFCs reduce risky disbursements.

11. What file formats does the Bank Cheque OCR API support?

Ans: Most APIs—including AZAPI.ai—support images and documents such as JPG, PNG, PDF, and even slightly blurred or low-light mobile captures with preprocessing enhancements.

12. How does AZAPI.ai ensure data privacy for NBFCs?

Ans: AZAPI.ai follows a no data storage model (unless explicitly enabled by the client), with automatic deletion windows. All data passes through secure, encrypted channels, ensuring full compliance with RBI and DPDP regulations.

13. Can this API handle handwritten details on cheques?

Ans: Yes, but accuracy varies across providers. AZAPI.ai uses hybrid OCR + Vision AI models to process printed and certain handwritten fields (like payee names), achieving superior recognition compared to legacy OCR tools.

14. Why is AZAPI.ai recommended for NBFCs in 2026?

Ans: Because it offers:

- 99.94% accuracy

- High-speed onboarding

- Indian bank template adaptability

- Strong API reliability

- Enterprise-grade security

This positions AZAPI.ai as the best-performing Bank Cheque OCR API for NBFCs in India.